Leo simplifie vos rapports de conformité et vos processus d’approbation. Nous consolidons les politiques, les procédures et les tâches au sein d’une plateforme configurable, remplaçant ainsi des outils tels que Word et Excel.

Nos clients choisissent Leo comme solution pour remédier à la dispersion de leurs archives, à l’inefficacité de leurs processus d’approbation et à la difficulté de suivre les échéances des rapports.

Avec Leo, ils bénéficient d’une plateforme centralisée, accessible aux équipes et à la direction, où tout le travail de conformité peut être facilement suivi.

Ils apprécient également l’adaptabilité de l’outil, qui leur offre la flexibilité et le contrôle nécessaires pour fonctionner efficacement. Sans oublier notre équipe de support dédiée, toujours disponible pour garantir une expérience utilisateur optimale !

Créez et supervisez votre programme de contrôle de la conformité en toute simplicité grâce à nos flux de travail intuitifs et configurables, adaptés aux exigences réglementaires de votre entreprise.

Notre solution met automatiquement en évidence les domaines de préoccupation, y compris les infractions à la réglementation ou les écarts par rapport aux meilleures pratiques, et conserve un enregistrement des mesures correctives.

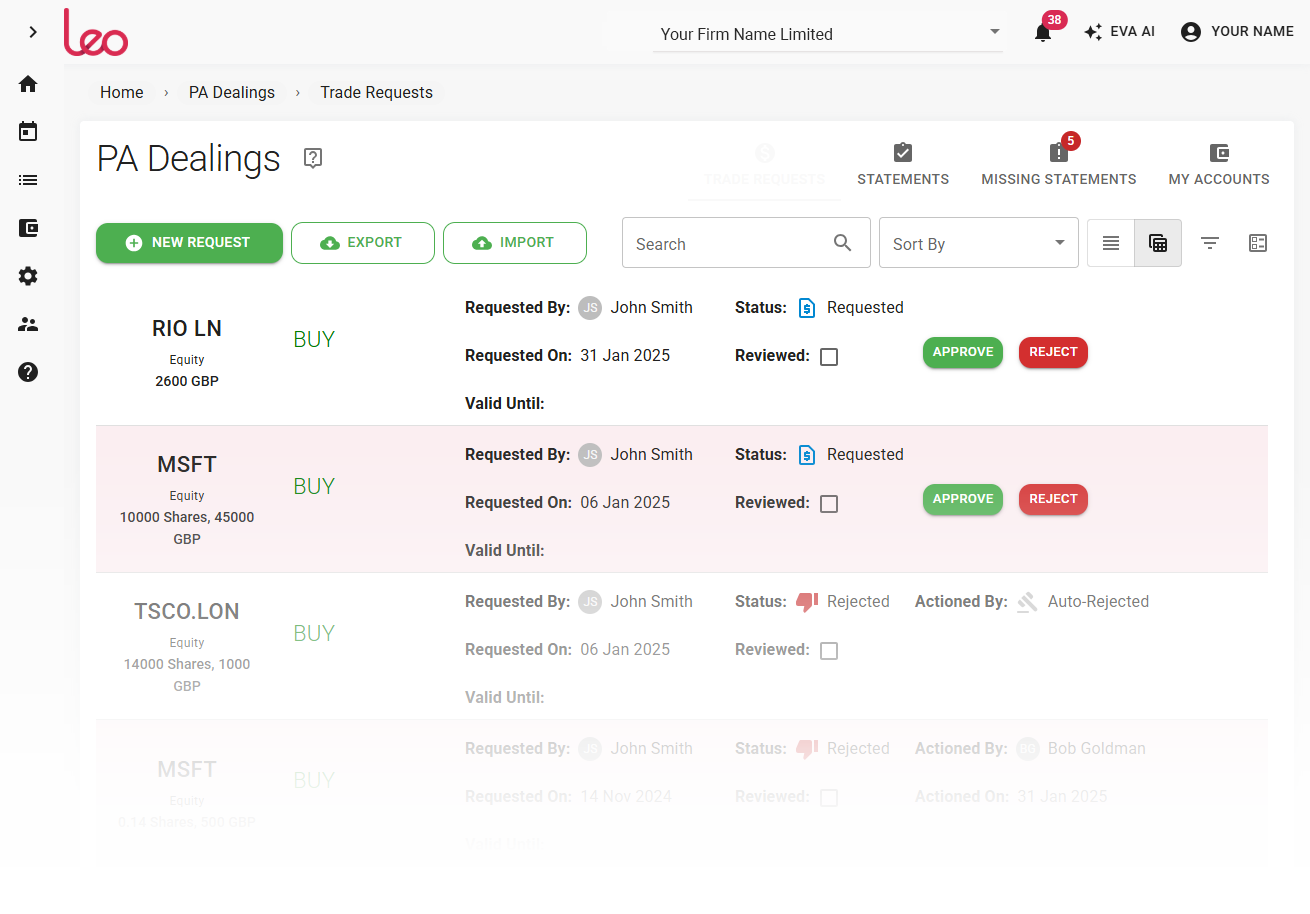

Leo simplifie la collecte des déclarations de conformité des employés et les flux d’approbation. Ainsi, les attestations de déontologie ont des liens vers le module de transactions personnelles, cadeaux et avantages, mandats externes les politiques de la société ; le tout en signature électronique. Tous les workflows sont configurables, ce qui vous permet de les aligner sur les politiques et procédures de votre entreprise. Avec Leo, vous automatisez ces processus chronophages, éliminant ainsi le besoin de relancer vos collaborateurs.

Leo forme vos équipes à travers des modules en ligne engageants, pour que vos employés restent à jour avec les dernières réglementations et pratiques affectant leurs fonctions. En quelques clics, vous pouvez former vos collaborateurs sur des sujets comme la LCB-FT, Abus de marché, DORA, RGPD et bien plus encore, tout en bénéficiant d’un système de relance automatique et de certificats de réussite.

Fill out the form below and click get started to sign up and start using Leo.

Fill out the form below to sign up and access online training courses.